If you're a brand-new motorist, you do not have a well-known driving document that shows insurance companies you're much less of a threat. On the flip side, a background of car accidents and tickets can cause your prices to rise. If you're a young vehicle driver or you have actually lately been in an accident or gotten a ticket, you're most likely wondering when your prices will decrease.

In this post Why do automobile insurance coverage prices go up or down? If you damage your cars and truck or somebody else's home, or you hurt or eliminate a person in a vehicle crash, your automobile insurance will be there to minimize the resulting costs.

Consequently, your driving history has a direct effect on the price you'll pay to bring insurance. If you have a tidy driving record, you'll likely be considered a secure vehicle driver as well as gain from lower rates. If you have actually been associated with crashes or ticketed for significant web traffic offenses, there's a great chance you'll pay even more.

6 Easy Facts About Does Insurance Go Down When You Turn 25? - The Simple ... Shown

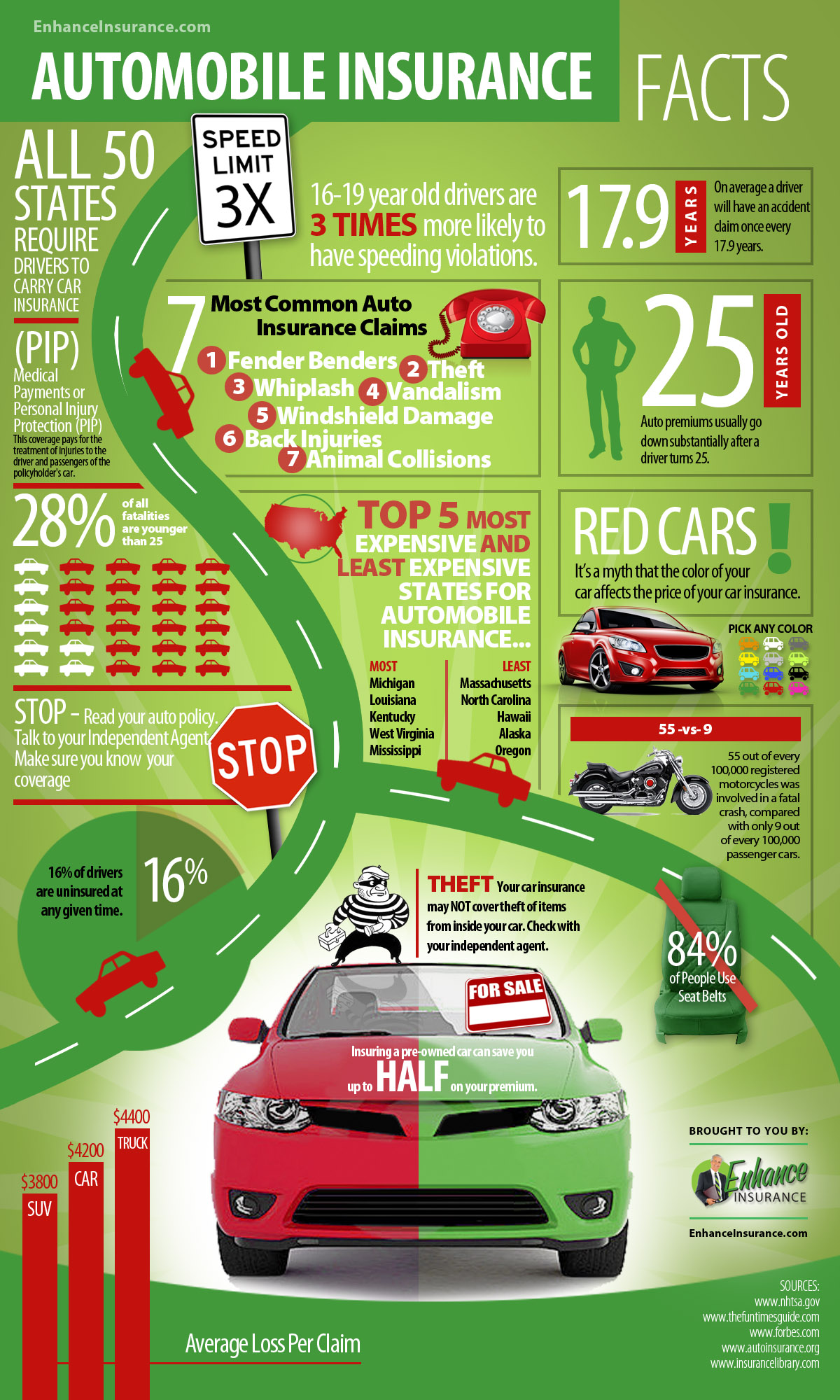

Insurance companies typically charge more for youths below the age of 25.: Statistically speaking, a lot more guys than females die every year in automobile crashes much more than double according to the National Freeway Traffic Safety Administration. Guy have a tendency to drive even more miles as well as involve more often in high-risk driving, such as driving while intoxicated, speeding, and also not using seat belts.

This is due to the fact that more skilled chauffeurs are much less most likely to have crash cases than inexperienced motorists, which normally indicates older vehicle drivers are more economical to insure than more youthful vehicle drivers. From the viewpoint of car insurer, 25 is the age at which you're thought about a knowledgeable motorist. This is assuming you've had your permit for many years, that is.

A nonrenewal is when your insurer picks not to restore your plan when it ends. Generally, these rises often tend to remain on your premium for three years following your claim. If, however, you had a strong driving record prior to an at-fault mishap, you might not see a boost in all.

The 10-Second Trick For Car Insurance Faqs : Farmers Insurance

As an example, although a DRUNK DRIVING will likely lead to your insurer making a decision to not renew your policy, a speeding ticket may simply result in a higher costs. It truly depends on exactly how your state and insurance provider treat the particular relocating offense. A speeding ticket will typically come off your record within 3 years.

Does vehicle insurance coverage go down if you enhance your credit report? Your insurance coverage rating resembles your credit history in that it's identified making use of the information in your credit record. Insurance policy firms take a look at info from your credit scores history, such as your settlement history, credit scores use, new applications for debt, and also arrearage, and they use a weighted rating per element.

Other things that may be taken into consideration consist of just how long you have actually been driving, your driving record, and your cases history. Why Fees as well as Quotes May Differ To help guarantee you receive an exact quote, it is necessary to supply total as well as exact details. Incorrect or incomplete info can create the quote total up to vary from the actual price for the policy.

Not known Incorrect Statements About Why Your Car Insurance Rate Changed - Root Insurance

If you neglect details in the estimating process about crashes you have actually remained in (even small ones), your policy price might be greater. If you neglect to provide information about your loved ones' driving history, such as speeding tickets, this may cause a greater price. Seeing to it you have the right info can make the procedure of getting a quote easier.

You're sharing the danger with a pool of vehicle drivers. Insurance coverage works by transferring the danger from you to us, your insurance policy business, and also to a huge team of various other individuals.

The only time the majority of us assume regarding our automobile insurance is when there misbehaves information, like a ticket or a mishap. When you're young, solitary as well as incident-prone, rates only seem to go one way: up. There is an other hand. Tickets diminish your record, and also so do crashes.

Everything about Auto Insurance Quotes - Save Today - Safeco Insurance

KEY TAKEAWAYSCar insurance policy premiums can enhance for numerous factors, but there are many points you can do to balance out the rises. Some big life adjustments, like acquiring a house as well as getting wed can decrease car insurance coverage costs.