Advertisement, Getting a cost-free Home Insurance coverage quote is a terrific method to make sure that you're not paying too much for your present plan. Click below to obtain a totally free quote - make sure your home is totally covered.

What loss of use protection will not cover Loss of use covers your extra living costs while your house is uninhabitable. This indicates that it doesn't cover: Regular expenses that you currently sustain, such as your mortgage payment and also real estate tax. credit. Any type of expenses that take place after your house is once again fit to reside in.

What personal responsibility insurance coverage will not cover Finally, individual obligation has 2 exemptions: It doesn't cover individuals that reside in your house It does not cover intentional damages For example, if your next-door neighbor comes for a check out, slips dropping the stairs, and also fractures his ankle, personal responsibility would certainly cover his medical bills. cheapest homeowners insurance.

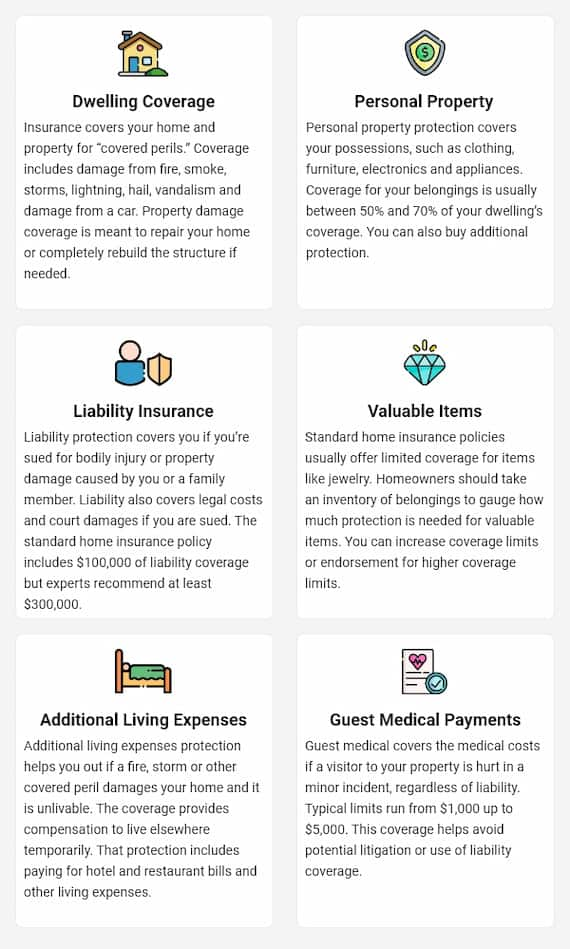

Homeowners Insurance Characteristics: Dwelling Insurance coverage Covers the expense of repairs and/or restoring your residence if harmed by a covered peril. -Floods, quakes or sinkholes-Damage brought on by negligence-Intentional damages Personal effects Coverage -Covers individual things in your house, up to 50 or 70% of the quantity of protection your home is guaranteed for-Coverage for dangers, damages or burglary- Covers damage to your residential property also if you're using it away from your home -Any type of shed items-Damage to personal effects due to floods or earthquakes.- Additional protection for high-value items need to be purchased independently- Automobile as well as airplane- Animals Loss of Usage Insurance Coverage -Insurance coverage for extra living expenses that can result from damages to your residence-It includes food, travel, and accommodations expenditures -Living expenses that surface area after your house is rebuilt- It only covers expenditures that exceed regular living prices- Home mortgage settlements, taxes Individual Liability Coverage -Obligation defense for mishaps and/or physical damage experienced by a guest-Lost wages reimbursement-Legal costs-Pays clinical expenses for people that do not live in your residence - Injuries to people that live in the home-Injuries that were caused on objective Important details to understand when choosing your plan protection There are several factors that you should weigh when picking your property owners insurance coverage plan.

Not known Details About Homeowners Insurance - Chubb

Insurers will not reimburse you for the full quantity of damages if your protection is less than that. Home coverage has a per-item limit which limitation might not suffice to cover high-value things (discount homeowners insurance). If you have prized possessions in your house a pricey coin collection or art, for instance you ought to consider a boosted individual residential or commercial property cyclist to protect your personal effects's full worth.

insurer a home owners insurance discount homeowners insurance insurance premiums affordable

insurer a home owners insurance discount homeowners insurance insurance premiums affordable

Does home owners insurance coverage cover water damages? While homeowner plans do not cover floods, they can cover various other water-caused damage. If a pipe ruptureds or there's a leakage, your insurance firm will more than likely repay you or pay for repair work. If the event is due to lack of maintenance or disregard, the insurer may not cover it.

homeowner insurance cheaper insurance premiums insurance cheap cheapest homeowners insurance homeowner insurance

homeowner insurance cheaper insurance premiums insurance cheap cheapest homeowners insurance homeowner insurance

While home insurance policies have a tendency to cover wildfire damages across the country, in areas like California companies can make some tweaks to their plans as a result of the high likelihood of such hazard (a home insurance). This might suggest elevating general rates or adding wildfire insurance coverage as a cyclist as opposed to it being included in the typical policy.

Exactly how much is home insurance? Insurance insurance coverage costs can vary widely depending on where you live, given that some states are taken into consideration risky areas for natural disasters, and also insurance companies bill more to cover these homes.

Indicators on Homeowners Insurance: Cost And Coverage - Rocket Mortgage You Should Know

If mold and mildew is triggered by covered risks such as accidental plumbing failings and is concealed within the wall surfaces, for instance, it will likely be covered (insurance premiums). On the other hand, external, visible mold and mildew as an outcome of carelessness or a left out peril, such as a flooding, will certainly not be covered by your home insurance plan (homeowners).

If the roofing system is harmed by a covered danger such as the weight of snow or criminal damage, it ought to be covered. However, if it's due to earthquakes or neglect on component of the insurance policy holder, it will most likely not be. Does property owners insurance cover termite damage? Unfortunately, no. Termite damages is thought about to be avoidable with normal upkeep and also parasite control.

You need to get normal examinations by a licensed pest control company to avoid any type of damage to your residence. credit. All-time Low Line Homeowners insurance protection will rely on the type of policy you get, just how much coverage you choose as well as the fine print on what is and also isn't covered. inexpensive.

Your home is the center of your world the area where friends and family satisfy and also memories are made. That's why it's worth protecting with house owners insurance policy. Let's see exactly how the right protection can aid secure what matters most to you. homeowners policy. Secure Your Home as well as Possessions Homeowners insurance supplies economic security for your residence as well as ownerships in case of abrupt as well as unintended damages.

Top Guidelines Of What You Need To Know About Homeowner's Insurance

a home insurance for home discount homeowners insurance affordable https://single-strategy-to-use-how-much-home-insurance-cost.s3.ams03.cloud-object-storage.appdomain.cloud/index.html cheapest homeowners insurance

a home insurance for home discount homeowners insurance affordable https://single-strategy-to-use-how-much-home-insurance-cost.s3.ams03.cloud-object-storage.appdomain.cloud/index.html cheapest homeowners insurance

To assist secure the home in a reduced degree, consider including an American Household Back-up as well as Overflow insurance coverage (insurance premiums). There are numerous variations of this insurance coverage based on where you live. Typical House owners Protections You can select from a variety of coverage options to obtain protection that's perfect for you.

condo insurance credit property insurance cheapest homeowners insurance deductible

condo insurance credit property insurance cheapest homeowners insurance deductible

You get a limited quantity of insurance coverage with your common homeowners insurance plan, but you can add even more coverage depending on the value of your personal building and exactly how much you desire to secure. If your home is damaged or ruined in an unexpected incident, like a fire or twister, home owners insurance policy can pay to fix or restore it. In this guide, we'll discuss all of the methods you're covered by property owners insurance.

Residence, Pays to repair or rebuild your house as well as frameworks connected to it, If your home is damaged by fire, wind, or any kind of various other covered catastrophe, Various other structures, Pays to fix or reconstruct your shed, bed and breakfast, fencing, or various other structures, If a framework not connected to your residence is harmed by a protected disaster, Personal residential property, Pays to repair or replace furnishings, electronics, cooking area home appliances, as well as various other things you possess, If your belongings are swiped or harmed by a protected loss, Additional living expenditures, Pays for resort stays, leasings, dining establishment bills, and various other temporary costs, If your home is damaged in a disaster and also you're unable to live there, Personal liability, Pays for visitors' clinical expenses and also legal expenditures, If you're legally responsible for a person's injury or property damage, Clinical settlements, Spends for guests' medical expenses from minor injuries, If a visitor sustains a minor injury at your home, no matter of fault, Home, Pays to repair or reconstruct your home and structures connected to it, If your house is harmed by fire, wind, or any type of other protected calamity, Other structures, Pays to fix or reconstruct your shed, visitor house, fencing, or various other frameworks, If a structure not connected to your house is harmed by a covered calamity, Personal effects, Pays to fix or change furnishings, electronic devices, kitchen area home appliances, and other things you have, If your personal belongings are swiped or harmed by a protected loss, Additional living expenditures, Spends for resort remains, rentals, restaurant costs, as well as various other short-lived costs, If your residence is damaged in a calamity and also you're unable to live there, Personal responsibility, Spends for guests' medical bills and lawful expenditures, If you're legitimately in charge of somebody's injury or property damages, Clinical payments, Spends for guests' medical bills from small injuries, If a guest suffers a small injury at your residence, despite mistake, Homeowners insurance coverage protections described, Homeowners insurance is greater than simply protection for your house in fact, it's usually referred to as a "plan plan" because it covers damage to your residential or commercial property as well as your obligation (suggesting your legal responsibility) for any injuries that you are accountable for - credit.

What Does Homeowners Insurance Cover? - Ramsey Solutions - An Overview

1. It pays to restore or fix your home or various other frameworks on your residential or commercial property, Homeowners insurance policy covers the cost of repair services or a complete reconstruct of your residence with your policy's residence insurance coverage if it's damaged or destroyed by a fire, tornado, or any kind of other hazard listed on your policy - insurance discount.

3. It spends for momentary living costs while your residence is being fixed, If your house is drastically damaged or damaged in a disaster and you need to remain someplace else, loss of usage protection can pay for a resort or short-term service (insurance cheap). It can additionally repay you for various other extra living expenses while you're unable to remain at home, like restaurant dishes, dry cleaning, as well as added transportation prices while your house is being reconstructed or fixed.

homeowners policy for home insurance a home owners insurance and home insurance homeowner insurance

homeowners policy for home insurance a home owners insurance and home insurance homeowner insurance

The 80% regulation additionally applies to just how you're paid on a claim. If your house is insured for much less than 80% of its real replacement cost as well as you file a home insurance coverage claim, your insurer will just pay out for the real cash money worth, or depreciated worth of the house. liability insurance.